Realty agents and mortgage how to cancel my llc brokers state the financing program is different this time around. However despite the fact that it's not a surprise, the factors behind the pattern how much is a timeshare can really feel distressing. " I think there is still a wish to use the product which is going to obtain you right into the residence and afterwards perhaps there might be a chance to re-finance right into a fixed-rate mortgage later on," Fratantoni told MarketWatch.

- This enables debtors to qualify for a much bigger financing (i.e., take on even more financial debt) than would certainly or else be possible.

- So as to get an understanding on what is in store for you with an adjustable-rate mortgage, you first have to comprehend how the product works.

- Adjusting financings are home loans that fulfill specific standards that permit them to be offered to Fannie Mae and also Freddie Mac.

- As soon as your home is worth less than the mortgage, or the customer loses a job, they foreclose.

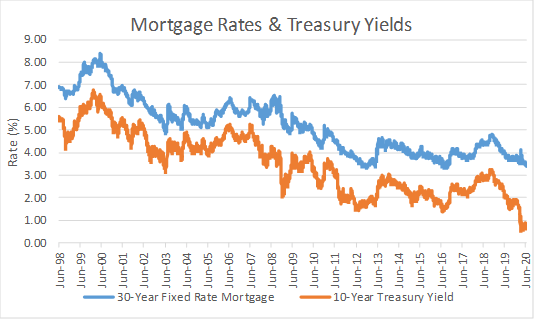

The typical agreement rates of interest for 30-year fixed-rate mortgages with adhering loan balances ($ 647,200 or much less) boosted to 5.53% from 5.36%, with factors rising to 0.73 from 0.63 for finances with a 20% deposit. The share of home loans that are adjustable-rate mortgages doubled to 10% in January, up from a 10-year low of 4% in January 2021, according to information from CoreLogic. The advantage of variable-rate mortgages is that the price is less than forfixed-rate mortgages. Those rates are linked to the 10-year Treasury note, which indicates you can acquire a larger house for much less. That's specifically eye-catching to new homebuyers and others with moderate earnings. Each lender chooses the amount of points it will include in the index price as component of the ARM margin.

Repaired

If your car loan's life time limitation is 5 percent over your start rate, your rate of interest can never ever surpass 8.33 percent. The most current Freddie Mac Primary Home mortgage Market research showed that 30-year set rates are averaging 4.2 percent. The spread has expanded considerably considering that 2012, to.87 percent-- nearly a full percentage point.

Just How The Auto You Drive Affects Your Insurance Rates

Thankfully, making the effort to recognize exactly how ARMs function can assist you be prepared in case your price rises. Some big items may not be offered to very first time house customers. Discover The Solutions You Required Browse Through our Understanding Center, where we damage down the home loan procedure so it's simpler to comprehend.

When ARM prices adjust, the new rate is based upon a rate index that reflects existing lending conditions. The brand-new price will certainly be the index rate plus a specific margin established at the time you secured the funding. So if the index goes to 3.5 percent when your rate readjusts and your margin is 2 percent, your new rate will be 5.5 percent. Convertible ARM have the alternative of converting their ARM into a fixed-rate home loan each time assigned in the home loan contract. Homeowners enjoy low initial prices along with the comfort that features having a fixed-rate choice. Once the fixed-rate section of the term mores than, the ARM adjusts up or down based on current market prices, based on caps governing how much the price can increase in any particular modification.

If you can not make the payments after the fixed-rate phase of the finance, you can lose the home. The Rocket Home Mortgage Discovering Facility is dedicated to bringing you short articles on house acquiring, lending types, mortgage basics as well as refinancing. We also provide calculators to establish house price, house equity, regular monthly home mortgage repayments and also the advantage of refinancing.

For 5 years, home purchasers that select an ARM take pleasure in fixed settlements, generally at a lower rates of interest than purchasers with a fixed-rate home loan. It's just after the introductory period finishes that ARMs may become extra costly as well as uncertain, depending on what is occurring with interest rates in the macroeconomic atmosphere. When obtaining into an ARM, it's helpful to comprehend the partnership in between primary and passion as well as just how it changes with time as you enter into your home loan term.

Loaning criteria are more stringent today than during the 2006 real estate bubble, Rugg kept in mind. In the real estate run-up more than a decade back, some lenders given out supposed "liar's financings," or home mortgages that called for little or no documentation of earnings. Today, banks require customers to verify their revenue to qualify for a funding. But economists say there are some differences in https://postheaven.net/denopexq93/an-overview-to-special-function-car-mortgages-taking-into-consideration-an-spv between today's pandemic real estate boom as well as 2006, such as banks' more stringent loaning requirements. They consist of interest-only home loans, where borrowers pay just the rate of interest on their financing for the initial three to 10 years. She's also not a follower of payment-option ARMs, where consumers can pay much less interest than they owe in exchange for that rate of interest getting contributed to the principal.